A&D

SUPPORT

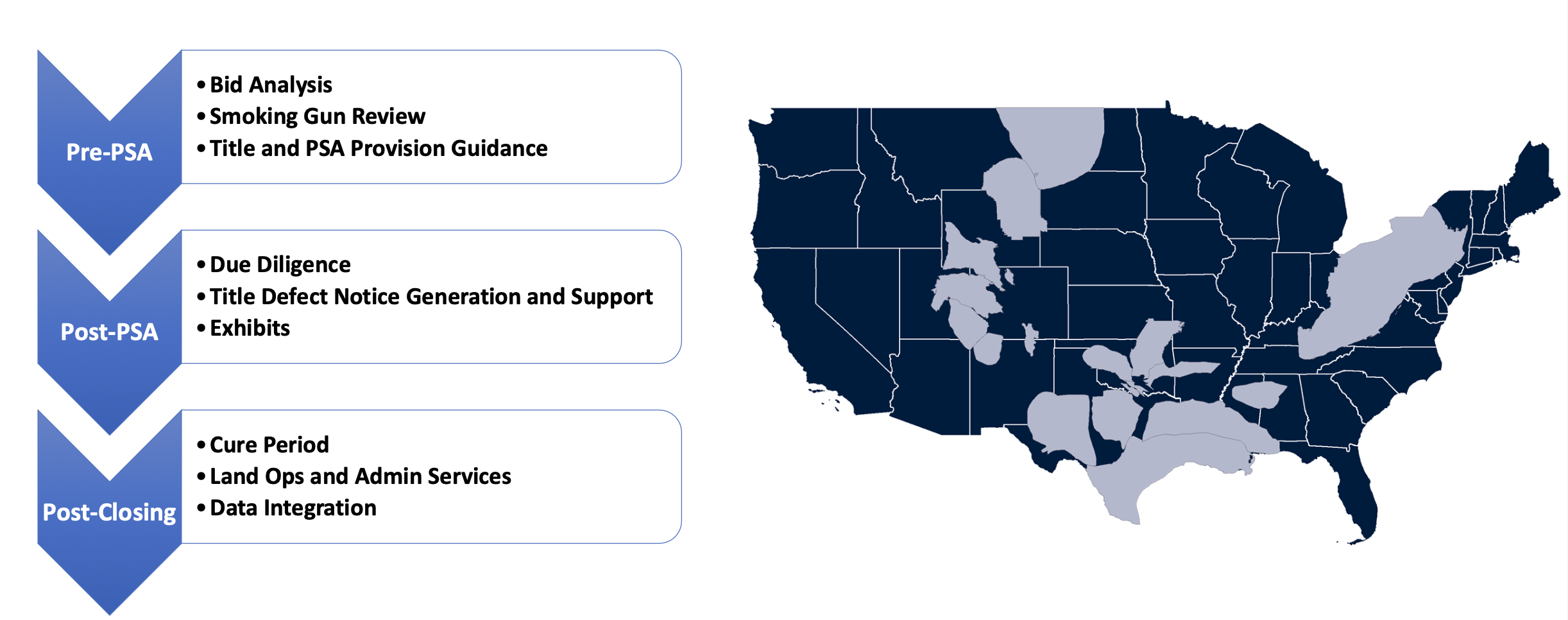

VVE offers Acquisitions & Divestitures (A&D) services to sellers and buyers in the upstream oil & gas sector, covering assets in all North American producing basins. This encompasses conventional and unconventional assets, both operated and non-operated, as well as minerals and royalties

PROJECT HIGHLIGHTS

Privately Held Company: facilitate the marketing and divestiture of over twenty non-core assets in West Texas, New Mexico, Oklahoma, and Kansas consisting of over 350 wells that sold for a combined $10MM

Portfolio Company: acquired ~3,300 net acres in a target zone-specific play in the Delaware Basin (New Mexico) assisted with title and divestiture diligence, resulting in a 5x multiple in 6 months from acquisition to sale

Portfolio Company: manage fast-paced acquisition diligence in Lea and Eddy Counties, NM, aggregating ORRI in strategic development areas

Portfolio Company: Acquired ~850 NMA in a bolt-on Area-of-Interest to establish 3 new DSUs for future horizontal development

Portfolio Company: divestiture counter diligence, exhibit and data preparation, and PSA advisory for 10,000 net acre/ ~10,500 BOEPD asset in the Delaware Basin (Texas)

Portfolio Company: prepare for potential divestiture compiling and drafting exhibits and data preparation, smoking gun review and reconciliation prior to process kickoff and PSA advisory of 100,000+ net acre/ ~25k BOEPD asset in Texas

Portfolio Company: facilitate title diligence and lease negotiation and review for ~20,000 net acres in new leases in South Texas.